Q1 2025 LTL BENCHMARKING UPDATE

Navigating New Dynamics: Forecasted LTL Industry Performance in Early 2025

The LTL industry continues to navigate an environment of uncertainty, shaped by fluctuating market conditions, evolving freight dynamics, and operational cost pressures. This is in parallel with continued consolidation among carriers. In an effort to provide clarity amid these challenges, the NMFTA Benchmarking Group has been instrumental in helping carriers elevate their performance through data-driven insights and best practices. Click here to learn how to participate in this valuable program.

Last updated: April 16, 2025

Introduction

At the time of the writing of this article, none of the Publicly traded LTL providers have reported their Q1 2025 results, this article is a summary of market forces that have affected all market participants in Q1, and the expected impact on performance for early 2025.

The less-than-truckload (LTL) sector began 2025 facing a confluence of soft demand, changing freight profiles, and operational shifts. The legacy of the Yellow Corp. shutdown in 2023 continues to reshape the competitive landscape, while the rollout of a new freight classification system by NMFTA is transforming pricing strategies and internal workflows. As carriers recalibrate their operations, efficiency and margin protection have become top priorities. This report highlights key developments in freight mix, pricing strategies, operational performance, and broader market strategy.

Freight Volumes and Mix Dynamics

LTL carriers have continued to experience weakened freight volumes, especially in industrial segments impacted by higher interest rates and cautious manufacturing activity. As truckload (TL) rates remain low, some heavier shipments that might traditionally move via LTL have shifted into the TL market, reducing the average weight per shipment and leaving unfilled capacity in certain LTL networks.

Carriers with expanded networks, especially those who acquired former Yellow terminals, sought to backfill capacity. This led some to take on denser or heavier freight, even at the cost of diluted yield, as they aimed to maintain linehaul utilization. Conversely, other carriers deliberately pruned lower-margin freight to protect pricing integrity.

Yield and Pricing Strategies

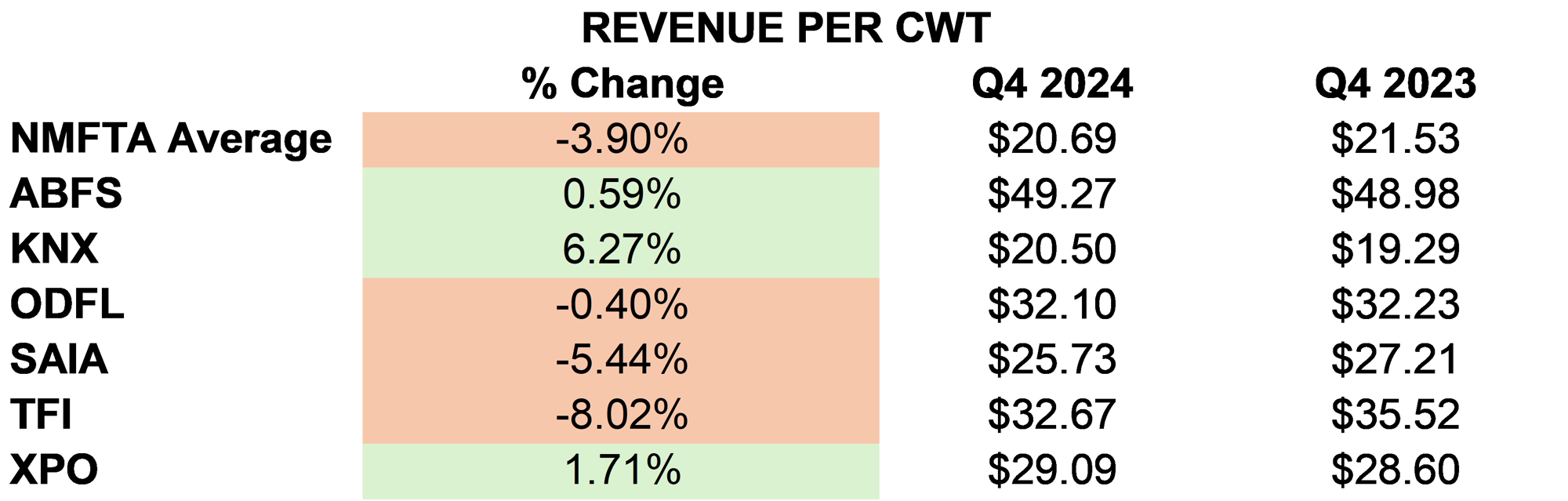

Despite soft volumes, many LTLs have successfully implemented contract rate increases, emphasizing pricing over volume. On a per-pound basis (revenue per hundredweight or CWT), core yield performance has remained positive for most carriers, although fuel surcharge reductions—driven by lower diesel prices—tempered overall revenue growth.

The divergence in strategy is evident. Carriers like Old Dominion and XPO prioritized yield in their Q4 filings, limiting volume and focusing on more profitable freight. Others, such as Saia, prioritized network utilization by onboarding higher-weight shipments. While this boosted revenue per shipment, it came with a trade-off: heavier loads often carry lower revenue per pound.

Operating Ratio Trends

Operating ratio (OR), the key industry profitability metric, trended higher across much of the industry in Q4 2024 due to lower volume leverage and winter-related disruptions.

Among the more efficient public carriers, Old Dominion continued to set the benchmark for OR performance, despite experiencing some deleveraging. Saia and XPO, both in network expansion mode, faced short-term margin pressure due to increased fixed costs and heavier freight. Asset-based divisions like ArcBest’s ABF Freight and TForce Freight (TFI) showed weaker ORs, reflecting ongoing integration efforts and network underutilization.

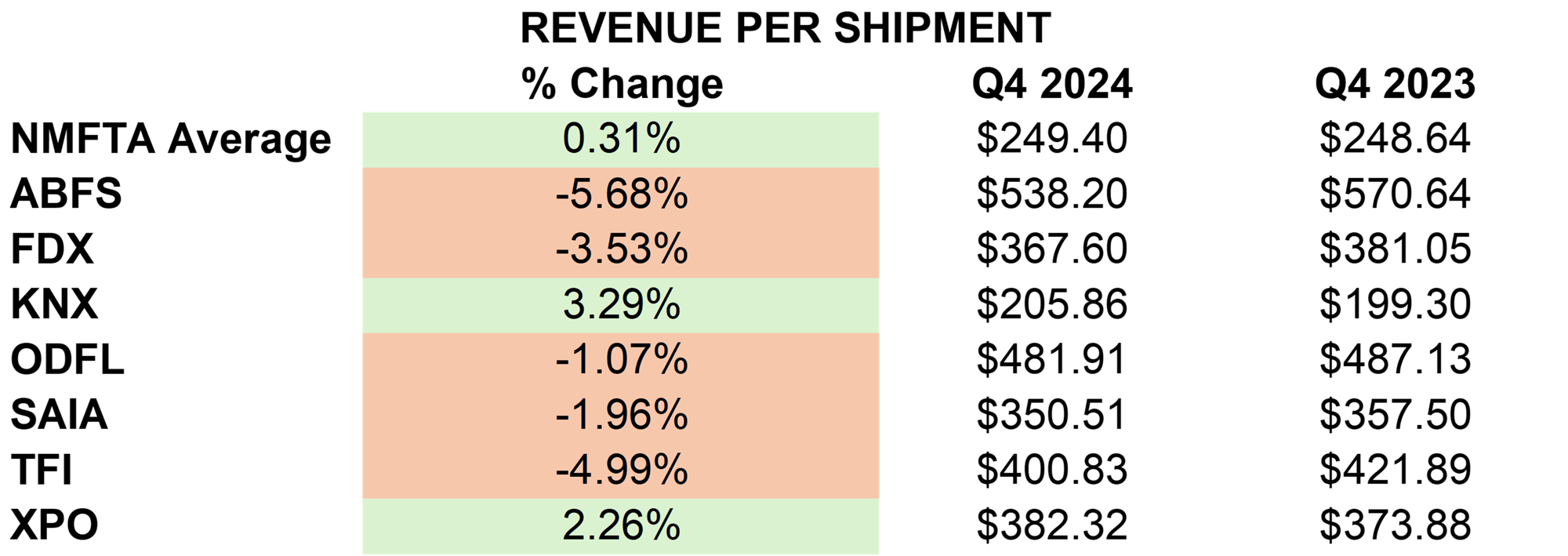

Revenue Per Shipment

Carriers with heavier shipments saw this metric rise, despite often lower revenue per CWT. In contrast, carriers shedding heavy freight to protect yield saw smaller shipment sizes and, in some cases, lower revenue per shipment.

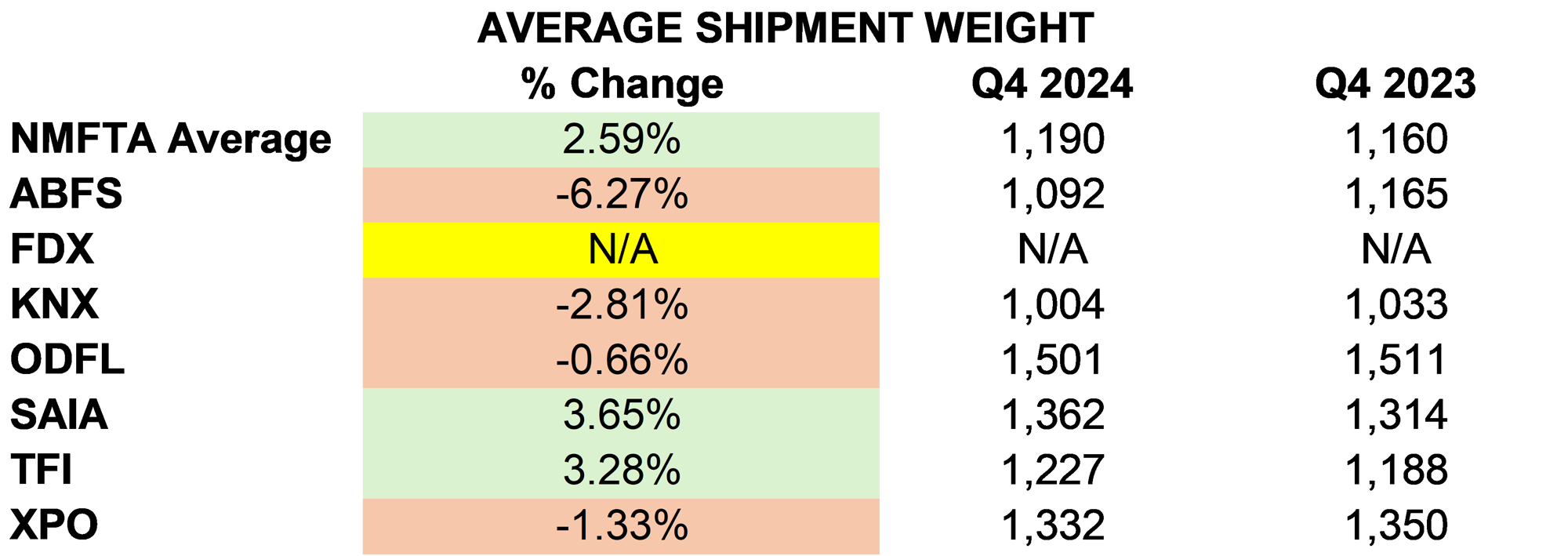

Weight per shipment served as a key indicator of freight mix strategy. Carriers like XPO and Old Dominion recorded modest declines in Q4 2024, reflecting a shift toward lighter, higher-rated shipments. Saia, on the other hand, saw weight per shipment rise sharply as it captured freight left behind by Yellow’s exit. Some regionals that filled market gaps in the Midwest and West may also be seeing heavier shipments.

A rise in weight per shipment isn’t inherently negative. With proper pricing, it can indicate better trailer utilization and more consolidated freight flows. However, it requires careful management to avoid yield dilution.

Revenue per Hundredweight (Yield)

Yield remained a bright spot for the industry. Most public carriers reported mid-single-digit increases in ex-fuel yield, supported by general rate increases and strategic freight pruning. Even as diesel prices reduced fuel surcharge revenue, core pricing remained firm.

Carriers that maintained lighter, higher-rated shipments—like XPO and Old Dominion—achieved stronger yield metrics. Others, such as ArcBest and Saia, experienced some yield dilution due to onboarding dense, lower-rated freight. Still, the pricing discipline was notable industry-wide, with no signs of a race to the bottom.

Private carriers also likely saw yield improvements on a core basis, though many dealt with more muted gains due to a heavier freight mix and lower fuel surcharges.

NMFTA Classification Overhaul: Early Impact

Q1 marked the rollout of Phase 1 of the National Motor Freight Traffic Association’s revised classification system. The new framework replaces thousands of commodity-specific classes with a smaller number of density-based categories, aiming to simplify pricing and reduce disputes.

Early effects were mixed. Carriers handling dense freight saw some downward class adjustments, slightly reducing revenue per pound. To adapt, many carriers ramped up investment in dimensioning and weighing technology, trained internal teams, and worked with shippers to ensure accurate bill of lading data.

The reform’s long-term promise is substantial: fewer reclassifications, more predictable pricing, and better alignment between actual freight characteristics and billed rates. So far, the transition has been smooth, with operational and pricing adjustments underway across the industry.

Carrier Strategies and Market Positioning

Carriers responded to the soft freight environment with a range of strategic initiatives, which have continued into early 2025:

- TFI (TForce Freight) is undergoing a significant reorganization, prioritizing service improvements, route optimization, and better freight selection. The company has paused acquisition activity to focus on internal network improvements.

- XPO is focused on yield-driven growth. After opening or re-opening 25 terminals in the past year, XPO has pursued profitable freight, even at the cost of volume. With strong technology investment and disciplined pricing, the company is improving OR while laying the groundwork for future volume gains.

- Saia continues to fill out its network aggressively, accepting heavier freight to drive terminal throughput. While this has led to near-term yield pressure and higher costs, the long-term goal is market share and OR improvement through density.

- Old Dominion is sticking to its organic growth strategy. With conservative volume acceptance and excess capacity held in reserve, ODFL is prioritizing network quality and long-term efficiency.

- ArcBest (ABF Freight) is creatively leveraging its hybrid model. By rebalancing truckload shipments into underutilized LTL capacity and emphasizing managed transportation services, the company is maximizing asset usage while maintaining flexibility.

Outlook for 2025

As carriers move through the year, a few themes will be critical:

- Pricing Discipline: Maintaining recently achieved contract rate increases will be essential. Carriers that flex rates tactically—protecting yield without sacrificing key accounts—will stay ahead.

- Efficiency Gains: With margins tight, continuous improvement in routing, labor management, and dock processes can drive OR improvement. Technology investments will be a differentiator.

- Freight Mix Management: The ability to attract the right freight at the right price—balancing volume with profitability—will be key. Some carriers may continue using creative tactics, such as moving TL freight on LTL assets to optimize throughput.

While some indicators point to stabilization, broader economic factors like trade policy, interest rates, and fuel costs remain wildcards. Nevertheless, the LTL sector has shown resilience. From quickly integrating Yellow’s displaced freight to adapting to the NMFTA overhaul, the industry has demonstrated its capacity to evolve.

Conclusion

Early 2025 presented LTL carriers with a challenging but defining moment. Volume softness, yield pressures, and shifting freight profiles all converged, it is expected that many carriers responded with decisive strategies – which will be described in Q1 results and filings. Whether through network expansion, pricing discipline, or operational optimization, LTLs are laying the groundwork for long-term competitiveness.

The rollout of the NMFTA’s new classification system adds a structural change that may streamline operations and enhance pricing consistency in the future. Meanwhile, public and private carriers alike are refining their mix of freight, investing in technology, and making bold choices about growth and efficiency.

As the year progresses, the industry’s ability to respond with agility—both defensively and offensively—will determine which carriers emerge strongest from the current downturn. Those that adapt best to shifting dynamics and stay disciplined in execution are poised to lead the sector into its next phase of growth.

About KSM Transport Advisors

Katz, Sapper & Miller (KSM) is one of the largest independent CPA firms in the U.S., with over 600 employees. Founded more than 80 years ago, KSM provides advisory, tax, and audit services across various industries. Their mission is to inspire great people to achieve great things, focusing on client success through innovative, expert advice. Employee ownership, commitment to community service, and a focus on diversity are core to KSM’s values, contributing to its recognition as a top accounting firm. Learn more.