Navigating Uncertainty:

LTL Performance in Q3 and Q4 2024

Introduction

The LTL industry continues to navigate an environment of uncertainty, shaped by fluctuating market conditions, evolving freight dynamics, and operational cost pressures. This is in parallel with continued consolidation among carriers. In an effort to provide clarity amid these challenges, the NMFTA Benchmarking Group has been instrumental in helping carriers elevate their performance through data-driven insights and best practices (source). This report examines the key performance trends from Q3 and Q4 2024 across both publicly traded and private LTL carriers, highlighting critical shifts in efficiency, revenue generation, and freight characteristics.

The ‘NMFTA Average’ cohort represented in the following tables consists of NMFTA Benchmarking participants that have reported Q4 results. In this updated edition, we have incorporated the full set of Q3 and Q4 results for all publicly traded LTL carriers.

Overview

The LTL trucking sector experienced notable shifts across both publicly traded and private companies in Q3 and Q4 2024. Financial performance, shipment volumes, and operational efficiency varied, with some carriers achieving cost improvements while others faced revenue pressure. In this report, we compare the NMFTA cohort to those publicly traded LTL carriers (and subsidiaries), that have reported their Q4 results at the time of this writing. Below is a summary of key trends observed in the sector.

Key Metrics Analysis

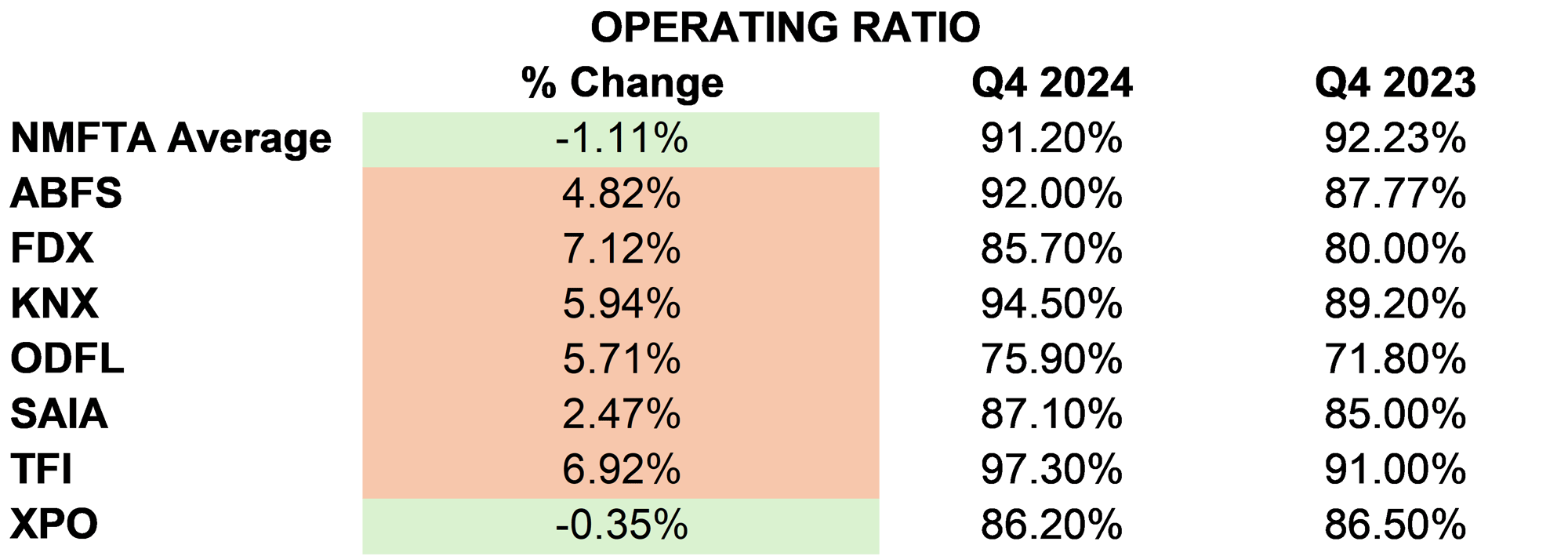

Operating Ratio

Publicly traded carriers generally maintained stronger operating ratios compared to private companies within the NMFTA cohort. Old Dominion Freight Line (ODFL) led the sector with a sub-76% operating ratio. Despite its industry leadership from a net profit perspective, ODFL’s OR worsened by 410 basis points compared to Q3. However, ODFL continues to demonstrate best-in-class profitability, with disciplined cost control and pricing strategies contributing to its strong position.

Saia (SAIA) and ArcBest (ABFS) both posted resilient ORs, with Saia benefiting from improved operational efficiencies and ArcBest leveraging its diversified service offerings to maintain stable margins despite market pressures.

TFI International (TFII) struggled with higher costs and declining LTL revenue, leading to a significant deterioration in its operating ratio. TFI’s LTL operating income plunged 34% in Q4, bringing its OR for their US LTL operating segment to near 98%. Management cited declining volumes and increased accident-related expenses as primary factors.

XPO (XPO), on the other hand, demonstrated consistent margin despite the market headwinds, achieving an 86.2% OR, improving by 30 basis points. This was driven by cost efficiencies and strategic freight selection, helping to offset volume declines.

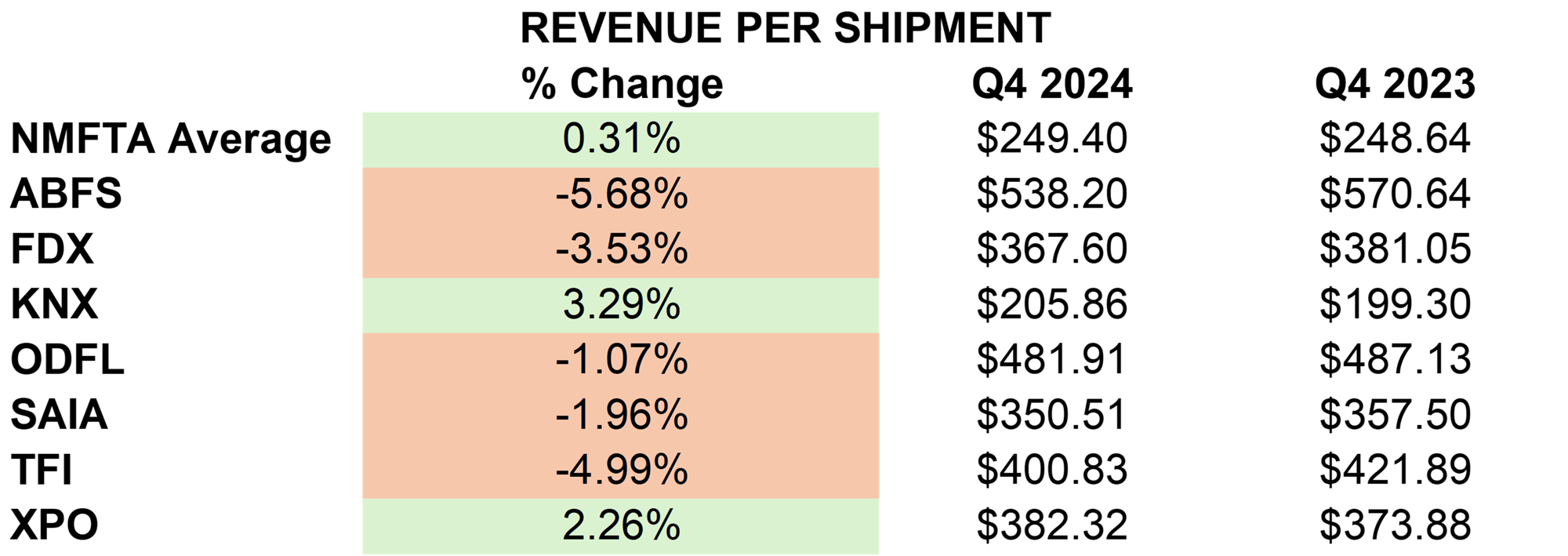

Revenue Per Shipment

Revenue per shipment results followed the broader ‘mix’ trend across both public and private carriers, reflecting competitive pricing and shifting freight patterns. Knight-Swift (KNX) had the strongest quarter-over-quarter (QoQ) change in this category, benefiting from increased volume and an expanded service footprint due to continued LTL acquisitions.

TFI saw a 13% year-over-year drop in LTL revenue, but has outlined a strategy to regain higher-yield small and mid-sized customers in 2025. XPO, however, saw a 6.3% increase in yield per shipment (excluding fuel surcharges), showcasing its focus on strategic pricing to offset volume declines.

Saia and ODFL both recorded revenue per shipment decreases YoY, with ODFL’s yield per shipment declining from $487 to $481. ArcBest, while impacted by pricing pressure in its asset-based division, maintained strong contract pricing strategies to support revenue stability.

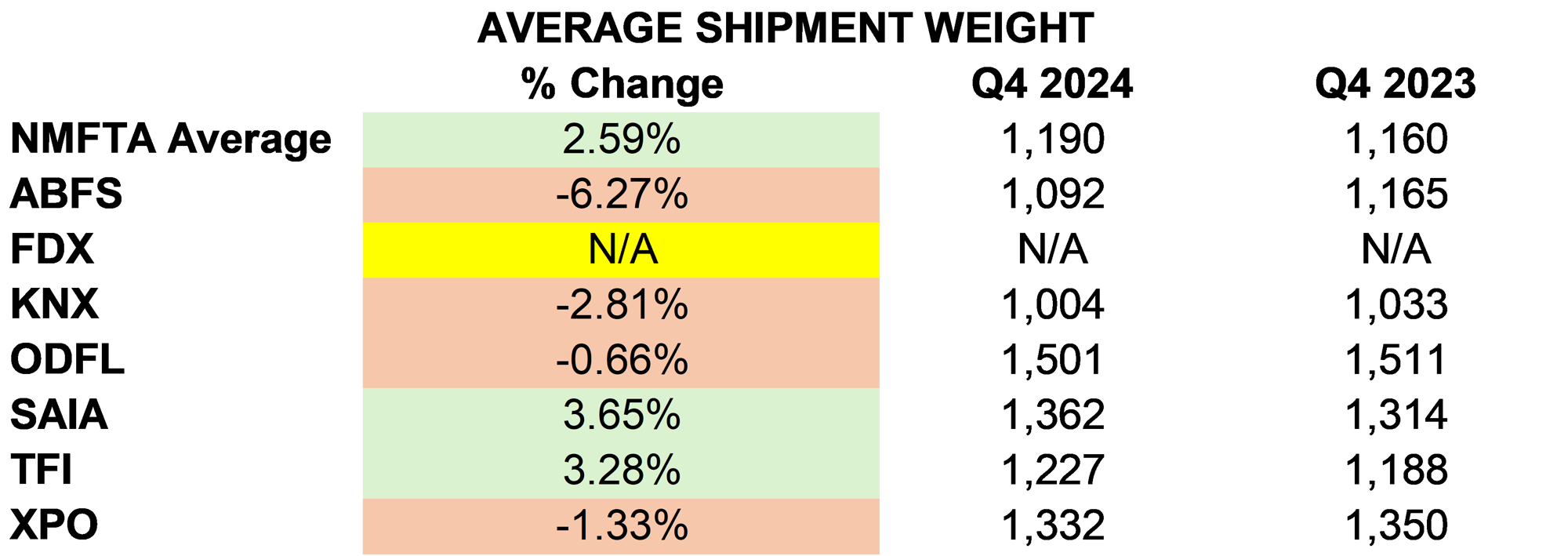

Weight Per Shipment

Average shipment weights showed mixed results across public LTL carriers in Q4 2024:

- ArcBest (ABFS) posted the largest decrease, with -6.27% decline/

- Saia (SAIA) and TFI (TFII) also saw weight gains, increasing 3.65% and 3.28%, respectively.

- Old Dominion (ODFL) and XPO (XPO) saw slight declines, with ODFL down 0.66% and XPO down 1.33%.

- Knight-Swift (KNX) reported the largest decline, at -2.81%.

- The NMFTA average increased by 2.59%.

This suggests that some carriers (e.g., ABFS, SAIA, and TFI) improved their mix toward heavier freight, while others (e.g., KNX, XPO, and ODFL) may have seen shifts in customer profiles or load balancing that resulted in lighter average shipments.

This development suggests an industry-wide shift toward heavier and more consolidated shipments for certain carriers, potentially affecting network density and capacity utilization differently across the sector.

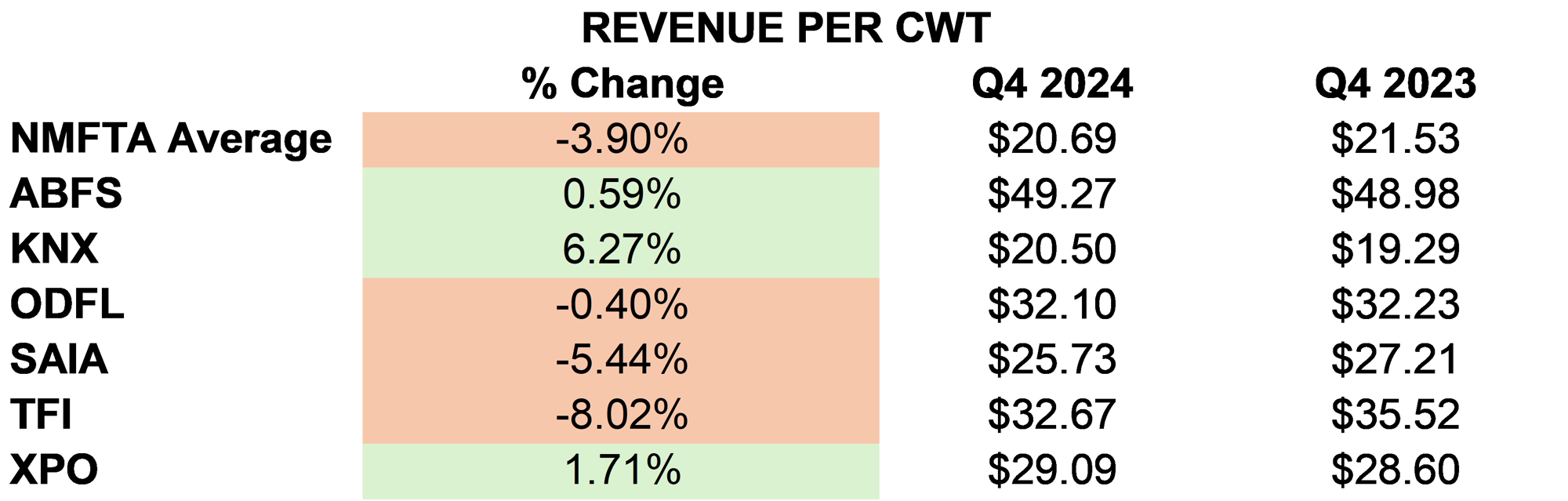

Revenue Per CWT

Revenue per hundredweight (CWT) remained variable across public LTL carriers in Q4 2024, with some achieving gains while others saw declines:

- ArcBest (ABFS) increased revenue per CWT by 0.59%, reaching $49.27 (up from $48.98).

- Knight-Swift (KNX) had the strongest growth at 6.27%, improving from $19.29 to $20.50.

- XPO also recorded a positive increase of 1.71%, rising from $28.60 to $29.09.

- Old Dominion (ODFL) saw a slight decline of 0.40%, dropping from $32.23 to $32.10.

- Saia (SAIA) experienced a 5.44% drop, declining from $27.21 to $25.73.

- TFI (TFII) had the largest decrease, falling 8.02% from $35.52 to $32.67.

- The NMFTA average declined by 3.90%, from $21.53 to $20.69.

TFI struggled with declining revenue per CWT due to volume losses but is focusing on optimizing freight mix. XPO improved revenue per CWT through strategic pricing and cost reductions, despite a modest decline in total volume.

However, when fuel surcharge revenue was excluded from calculations, carriers like ODFL and XPO still achieved revenue-per-CWT increases, reflecting strong core pricing strategies despite softening demand in certain segments.

Market Strategies and Outlook

TFI International (TFII) is recalibrating its strategy to regain profitability in its LTL segment. Management admitted network inefficiencies and volume softness hurt results in Q4 but is aiming for a turnaround via route optimization, cost reductions, and potential acquisitions. Additionally, TFI is prioritizing SME customers to drive higher-margin freight back into its network.

XPO (XPO) continued its network expansion strategy, integrating 25 new LTL terminals in 2024, improving operational efficiencies, and investing in technology for optimized routing and dock operations. The company is bullish on an industry recovery in 2025, citing margin expansion and operational leverage as key drivers.

Saia and ODFL both maintained aggressive terminal expansion plans, enhancing network density to drive long-term growth. ArcBest is leveraging its flexible business model—blending asset-based and asset-light solutions—to capture profitable market segments.

Conclusion

The LTL industry in late 2024 demonstrated mixed performance trends. Public carriers leveraged network efficiencies and disciplined pricing strategies to maintain profitability, while private carriers faced escalating cost pressures. TFI struggled with operational inefficiencies and declining volume, while XPO outperformed through disciplined pricing, improved network efficiency, and cost controls. Saia, ODFL, and ArcBest all showcased strategic growth initiatives and resilience in navigating market headwinds.

As 2025 unfolds, success will be driven by:

- Adaptability in pricing strategies

- Operational efficiency improvements

- Freight mix optimization.

A major unknown remains the potential impact of new tariffs (and retaliatory tariffs) on LTL and truckload carrier supply chains. These external factors could further reshape network dynamics, pricing strategies, and freight volumes in the months ahead.

About KSM Transport Advisors

Katz, Sapper & Miller (KSM) is one of the largest independent CPA firms in the U.S., with over 600 employees. Founded more than 80 years ago, KSM provides advisory, tax, and audit services across various industries. Their mission is to inspire great people to achieve great things, focusing on client success through innovative, expert advice. Employee ownership, commitment to community service, and a focus on diversity are core to KSM’s values, contributing to its recognition as a top accounting firm. Learn more.